Summary of establishment (incorporation) of company in Malaysia [2023 edition]

Lalaport opened in Malaysia in 2022

The increasing trend of expansion in the service industry in 2022

In 2022, urban development is taking place all over the city.

With its stable economic growth, the city is garnering lots of attention and is slowly turning into a hub in Southeast Asia, with lots of Japanese businesses expanding here.

The first “Lalaport” in Southeast Asia opened in January 2022. Traditionally, Malaysia has been mainly dominated by manufacturing and construction industries, but recently, the service industry has also been slowly expanding its presence in the country.

Let’s begin the explanation on setting up a company in Malaysia.

Summary of company formation in Malaysia

Under the new company act, there are three forms of company incorporation:

①Local corporation

②Branch of foreign corporation

③Representative office

<Q&A>

Q:Which is the most commonly used form among these 3?

A:The first one as it allows license acquisitions and tax benefits. |

The new Companies Act has 3 types for local corporations. A local corporation is a company incorporated in Malaysia under the New Companies Act.

・Stock limited liability company

This form of corporation limits the company’s liability to the amount of shares owned by investors. It is further divided into a public company (Bhd.) and a private company (Sdn Bhd).

A private company is defined as

・Less than 50 shareholders

・Restriction on transfer of shares

・Public offering of shares is not allowed

A public company refers to a company that takes the form of a limited liability company other than a private company.

・Company limited by guarantee

A company limited by guarantee is a type of company in which the liability of the investors is limited to a pre-determined guaranteed amount of investment. Under the new Companies Act, only this type of company is explicitly required to have articles of incorporation.

・Unlimited Liability company

Form of incorporation where liability of shareholders or investors are unlimited.

Furthermore, branch office and representative offices are described as below:

・Branch of foreign corporation

Foreign corporations are required under the new Companies Act to register with the Companies Commission of Malaysia (CCM) as a branch office of its foreign headquarters corporation if they wish to conduct business in Malaysia.

Since the Malaysian government encourages the establishment of local corporations, it is up to the discretion of the government on the approval status. Generally, the establishment of a foreign corporate branch solely for the purpose of conducting business is not permitted.

・Representative office

A representative office is a form of establishment with a 2 year establishment period solely for the purpose of market research, etc. prior to setting up its business in Malaysia, and is not allowed to conduct any form business activities.

Originally, the Malaysian government recommends the establishment of local subsidiary. As with foreign corporate branches, the establishment or renewal of a representative office is largely at the discretion of the government. A proper explanation of the reasons for the establishment or renewal is strictly required.

Summary of foreign investment regulations

Kuala Lumpur in 2021, where construction continues to grow.

The following is a brief introduction to the regulations of investment rate for each industry.

【Manufacturing industry】

Restrictions on foreign capital investment in the manufacturing industry were abolished in 2003, allowing 100% foreign capital investment in principle.

【Financial institutions】

In 2013, restrictions on foreign investment were abolished with the enforcement.

However, prior approval from Bank Negara Malaysia is required to acquire 5% or more of company’s shares, regardless of location- foreign or domestic (there are no legal restrictions).

【Other service industries】

Foreign investment is prohibited in the following industries.

①Supermarkets/mini-marts (with a store area of less than 3,000 square meters)

⑴Independent supermarkets with a store area of less than 3,000 to 5,000 square meters.

⇒If it meets the regulations and conditions of MDTCC’s definition of "superstore" guidelines, entry by 100% foreign capital is permitted.

⑵Supermarkets in department stores with less than 2,000 square meters are allowed to be fully foreign-owned.

②Grocery stores/general retail stores

③Convenience store

⇒As of December 2018, foreign-funded convenience stores are required to obtain prior approval. However, the content of the authorization requirements has not been clarified yet.

④Retailers in newspaper and media print

⑤Pharmacies (traditional and western medicine)

⑥Gas station

⑦Market (Wet supermarket) and roadside stores

⑧Projects involving national strategy benefits

⇒Malaysian government has set a maximum foreign investment ratio of 30% or 49% for strategies related to water, energy, power supply, broadcast, defence, security, etc.

⑨Fabric stores, restaurants (not the high-end), bistros, jewellery stores, etc.

Establishing a company with 100% foreign investment status in other industries is possible.

It is possible to be a fully foreign-owned establishment for the service sector other than the ones listed above.

The authorities for each industry is as listed as below.

- Manufacturing: Malaysian Investment Development Authority (MIDA)

- Wholesale, retail, restaurants, service industry: Ministry of Domestic Trade, Cooperative and Consumerism (MDTCC)

- Tourism: Ministry of Tourism Malaysia

- Transportation: The Land Public Transport Commission and Royal Malaysian Customs

- Construction: Construction Industry Development Board CIDB)

In 2020, the number of modern shared offices have increased. It is possible to set up a company with low initial cost.

What is company secretary?

Overview of company secretary

Company Secretary is in charge of preparing documents for various registrations of company establishment, as well as proceeding with government procedures, as stipulated by the new Companies Act. Each company must appoint a Company Secretary and register the company upon establishment.

Company secretary plays an important role in setting up of an organization. Organization management can vary greatly depending on the requested secretarial role. Some precautions should be taken as follows:

- Obligation in assigning company secretary

All companies in Malaysia are obliged to have one or more company secretaries.

- Company secretary requirements

The Company Secretary must be 18 years or above and a neutral party, whose principal place of residence is Malaysia. He/she must possess related qualifications and has to be a member of a recognized organization such as the Institute of Company Secretaries or hold a license by the Registrar of Companies Malaysia.

- Appointment and dismissal of company secretary

Appointment and dismissal of company secretary is by resolution of Board of Directors.

Procedures for establishing a company in Malaysia

Shall we go over the procedures in establishing a company in Malaysia. The procedure is roughly listed as below.

- a.Company name application (name search)

- b.Selection of founder and board of directors during incorporation

- c.Preparation of Articles of Incorporation

- d.Determine authorized capital and paid-in capital

- e.Company establishment registration

- f.Resolution of the board of directors, submission of prescribed forms

- g.Opening of bank account, remittance of capital

- h.Transfer of shares and capital increase by founder

Preparation for company establishment

<Q&A>

Q:What should I start preparing first?

A:It is better to prepare beforehand as you will need the following documents and information |

The company secretary will usually handle the incorporation procedures of company establishments in Malaysia.

The following documents and information are usually requested by the Company Secretary, so it is best to prepare them in advance.

- Scanned copy of founder’s passport page (with picture) and full name in English

- Three company name candidates(〇〇○Sdn. Bhd.)

- Director’s residential address and mobile number

- Full names and passport copies of other directors if any

- Name of shareholders, number of shares held, capital amount (assuming 1 share = RM1), passport copy

- Shareholders and directors proof of residential address (utility bills are acceptable)

- Business office address and mobile number

- Business plans to be listed in the Articles of Incorporation (more than one item)

- Name of branch and bank of client’s that they plan to open on their own

- Authorized signature for bank transactions

- Financial year end period of business

a.Company name application(Name search)

Name search is a process in checking the availability of desired company name in Malaysia. Similar company names are distinguished by either being used or not in use. Those that are read similarly but contain minor differences in the spelling may be considered invalid.

Additionally, company names of business with non-existing business models any longer may also be restricted for usage.

Further restrictions are also imposed onto company names that are considered inappropriate for the business. In such cases, use of the name may be permitted accompanied by an explanation and RM300.00.(Refer to guideline)

Since there is a possibility for the first choice to be rejected, it is recommend to prepare three corporate candidate names (00xx Sdn Bhd).

<Q&A>

Q:How soon will I have the results of the name search?

A:You will receive the results within 1~2 days from application. |

The following documents are to be submitted to SSM (Suruhanjaya Syarikat Malaysia) within 3 months after company name has been decided.

<Documents to be submitted>

- Articles of Incorporation and By-Laws of company

- Statutory Declaration of Secretary (Form 6)

- Statutory declaration by directors and founders (Form 48A)

- Request for availability of corporation name (copy of Form 13A)

- English version of parent company's articles of incorporation (notarized and certified in Japan)

Choosing a company name is the first step in establishing a company

b.Choosing the founders and board of directors

Appoint at least one director and at least one of the directors must be a Malaysian resident. That director does not have to be a Malaysian. Usually, the director also serves as a shareholder.

<Q&A>

Q:Is it ok to have only one director?

A:Yes. The new Companies Act, published in September 2016 that came into effect on January 31, 2017 relaxed the previous requirement of two Malaysian resident directors to only requiring one Malaysian resident director. |

c. Preparation of articles of incorporation

In Malaysia, the Articles of Incorporation are broken down to two parts, called M&A.

①Memorandum of Association

②Articles of Association

Description of Memorandum of Association are as follows

- ⑴Company name

- ⑵Registered address ※has to be within Malaysia

- ⑶Purpose of incorporation ※The scope of business should be stated broadly so as not to put the company at a disadvantageous stage

- ⑷Company authority

- ⑸Limited liability of shareholders

- ⑹Authorized capital

- ⑺Company’s ability to increase or decrease it’s capital or to split it’s stocks

Articles of Association are specified below

- ⑴Number of directors

- ⑵Holding period

- ⑶Detailed regulations on matters related to the company's internal structure

E.g.: ・Restriction on transfer of shareholders

- Number of directors

- Term of office of directors

- Notification method of shareholders' and board of directors' meetings, etc.

As mentioned previously, the registration procedure of a company is usually carried out by the Company Secretary.

Typically, a company secretary or a law firm will handle the registration procedures.

※Company Secretary: A role similar to that of a judicial scriber in Japan.

Preparation is highly recommended prior to registration. Consult with experts regarding the preparation process.

d.Authorized and paid-up capital

RM 1 is the minimum paid-up capital stipulated by the Malaysian Companies Act. However, for Japanese nationals to work as a director or a representative in a Malaysian corporation under the Employment Pass, the minimum capital requirement depends on the Malaysian capital ratio in relation to type of business. It is necessary to meet the funds requirement especially for Japanese wishing to work in Malaysia.

For the food and beverage, retail, trading, and service industries, a minimum paid up capital of at least RM1 million is required to obtain a license.

e.Company registration

This process is also handled by the company secretary.

Summary of Board of Directors meeting requirements

・Procedures for holding a meeting of the Board of Directors

Notices have to be delivered regarding meetings of board of directors.

The notice must include the date, time,location and agenda of the board meeting. This notice may be delivered via phone, fax, e-mail, word of mouth, or by any other simple method. Unlike the General Meeting of Shareholders, no specific convocation period will be set but is advisable to, taking into account preparation and travel time, if any.

In Japan, the minimum attendees for Board of Directors meeting is a majority of the members of the Board of Directors. However, in Malaysia, the minimum attendees are two members or as determined by the Articles of Incorporation.

・Location and resolution of board of director meetings

There are no specific regulations regarding the location of Board of Directors meetings. These meetings can be held online as stipulated in the Articles of Incorporation.

In addition, if all directors are in favor of a resolution, the resolution can be made in writing with the signatures of all directors. Resolutions are normally decided by a majority vote of those present.

・Election & dismissal of board of directors

In principle, the election of directors is decided by a resolution of the shareholders' meeting. But the Board of Directors may also elect directors in accordance with the Articles of Incorporation. Same goes for the dismissal of board of directors.

For public companies, prior notice must be given to the directors who are to be dismissed.

・Term of office of directors

For a public company, all directors automatically retire at the first annual shareholders' meeting. However, the same directors may be re-elected at any subsequent annual meeting. One-third of the directors (or as close to one-third as possible if the number of directors is divisible by 3) will retire from office in subsequent meetings. The order of removal will start from the director with the longest tenure. Directors who have retired may be reappointed again. In the case of a privately held company, the term of office is determined in the articles of incorporation.

・Resignation

When a director resigns, he/she submits a written resignation, which must be approved by the board of directors prior to becoming into effect. However, if the company has only one director, the resignation will only be in effect once a successor is appointed.

・Representatives of directors

Similar to the concept of representative director in Japan, one managing director must be appointed from among the directors. The term of office is not limited by registration as a Managing Director, and the Managing Director is not required to resign at a general meeting of shareholders.

・Remuneration of directors

The remuneration of directors of Malaysian public companies are also subject to resolution at a general shareholders' meeting. The remuneration of directors of a private company can be resolved by the board of directors by stipulating in the articles of incorporation, but the shareholders must be notified within 14 days of the resolution.

Webinars to help you set up your company

Webinars are hosted on CONNECTION from time to time.

|

|

This webinar talks about the basic requirements, procedure and trends in obtaining a work visa in Malaysia. |

|

|

This seminar is designed for expatriates (or those thinking of moving to Malaysia) who wish to gain a deeper understanding of financial management abroad, including tips in utilizing balance sheet (BS) in making management decisions.

|

|

|

This seminar is designed for expatriates (or those thinking of moving to Malaysia) who wish to gain a deeper understanding of financial management abroad, including tips in utilizing balance sheet (BS) in making management decisions.

|

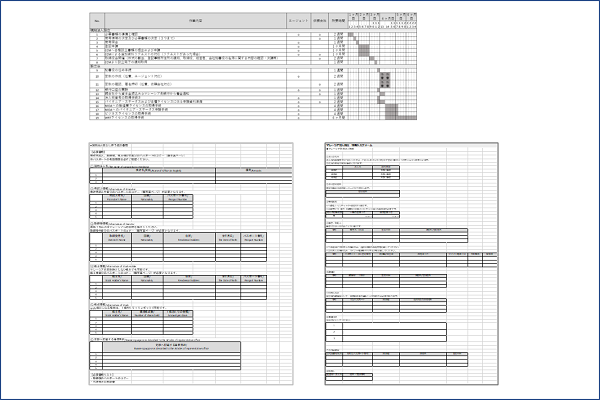

Dowload information on establishing your company in Malaysia(Excel file)

Download an excel spreadsheet detailing a schedule in incorporating your company in Malaysia, a list of documents to be submitted for incorporation, and information input form for incorporation in Malaysia. Please take advantage of this information and facility.

You can use this excel form as it is

Related information

Download free market research reports

CONNECTION provides a variety of market research reports and data that are useful for business expansion in Malaysia for free. Please register as a member to use this free service.

Free (online) consultation regarding establishment of business in Malaysia is available.

- I would like a cost estimate for setting up a company

- I would like to be introduced to a reliable accounting firm and company secretary

- I would like to know how long would it roughly take in setting up my company

- What sort of business licenses do I need?

Please feel free to contact us via the enquiry form below.

This article was written in collaboration with Tokyo Consulting Firm.

While we try our best in making sure the information provided in the contents and articles of this site is as accurate as possible, we do not necessarily guarantee the accuracy of the content. Unauthorized reproduction of content is prohibited.