Foreign Direct Investment (FDI) trends in Malaysia

Foreign Direct Investment (FDI) trends in Malaysia

Foreign direct investment (FDI) is important for a country’s economic growth. Countries rely heavily on FDI for the growth of their economy performance nowadays. From a different perspective, many countries do not have sufficient information in their country’s development efforts. In terms of statistics, Malaysian economy is largely powered by FDI. FDI doesn’t just expand capital, but also transfers skills and expertise to developing nations.Foreign direct investment (FDI) is known as a type of investment whereby foreign capital is injected into projects carried out in other countries. In other words, FDI is known as a transfer of fund from country A to B through long-term commitments usually including cooperation of expertise, cross-border acquisitions, transfer of specialities, greenfield investments, and joint ventures. Many less developed and developing countries are participating in the development of foreign direct investment. 20 years ago, foreign direct investments have been rapidly growing around the world, especially in less developed countries, as they have been considering this form of investment as an important strategy in further developing and growing their economies.

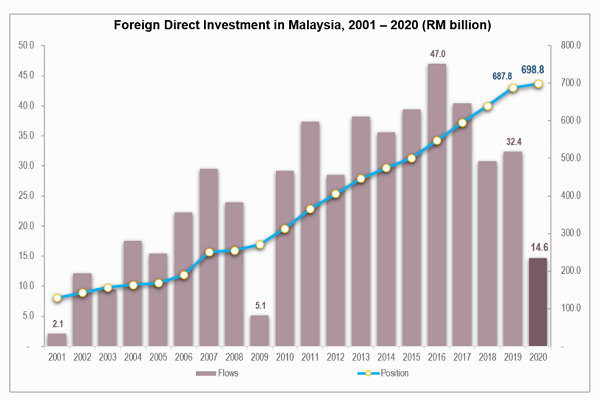

In the graph below, we can see the performance of foreign direct investments in Malaysia from 2001 to 2020. The fluctuations in foreign direct investment inflow into Malaysia from these years have heavily impacted the country’s economy.

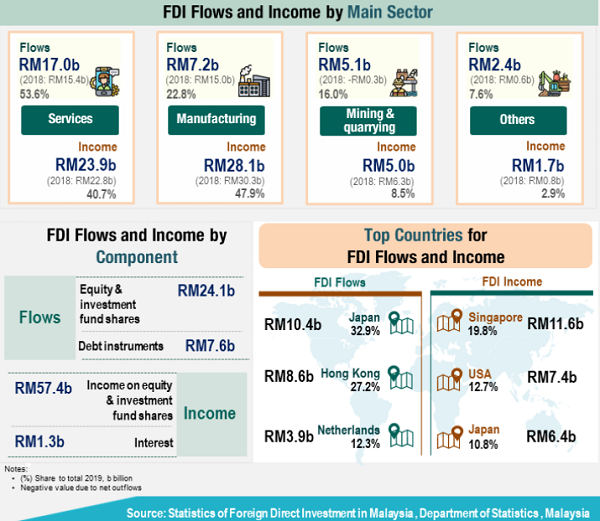

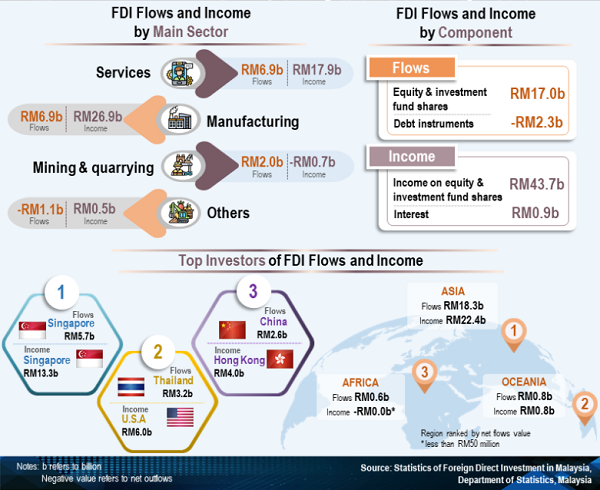

2020’s edition of DOSM report states findings that the services and manufacturing sectors contributed to FDI flows in 2020, followed by mining and quarrying. Investments in the services sector particularly, in the financial and utilities sectors, were especially high. While investments in the manufacturing sector mainly in the electrical, transportation equipment, and other manufacturing sectors were high as well. The main countries for FDI flows were Singapore, Thailand, and China.

On the other end, foreign direct investment traffic has expanded by 3.1% to RM32.4 billion in 2019 from RM30.7 billion the previous year mainly from a rise in healthy activities from Japanese firms. Looking at a different position, FDI grew from 2018 at RM639.7 to RM687.8 at the end of 2019. However, investment income has decreased from RM 60.2 billion in 2018 to RM 58.7 million.

FDI inflows were mainly concentrated in the services sector, particularly in the health care, real estate, and finance industry. Manufacturing was the second largest sector, mainly in the form of bonds and equities in refined petroleum products and electrical and electronic products, followed by mining and quarrying. Japan, Hong Kong, and the Netherlands were the main FDI investors in 2019.

FDI flow in 2019

FDI flow in 2020

There is no point in denying the fact that foreign direct investments (FDI) is currently on the low in Malaysia. Among other ASEAN countries, Malaysia is currently behind Philippines, Singapore, Indonesia, Vietnam, with a decrease by 68% in 2020’s FDI, lower by 37% compared to Southeast Asia’s average rate at 31%. Although this may make Malaysia seem like an unfavourable country for foreign investors, however, there are still other factors to be taken into consideration and countermeasures in combating this set back.

The main reason for the decrease in Malaysia’s FDI

In order to understand the decrement in Malaysia’s FDI, it is necessary to look at it from the big picture, taking into consideration all possible factors. This will allow recollection of recent major events from recent years.This failure started post GE-14 elections in May 2018, where foreign investors started losing faith in the country from decisions made by Barisan Nasional successors. From the abrupt cancellation of multi-billion ringgit projects undertaken by foreign partners to the cancellation of major infrastructure development projects, it was undeniable that the country would soon be overtaken by other countries.

The failure during Pakatan Harapan administration in maintaining policies and foreign relationship ties, revoking previously made promises and contracts made prior to its term in office, inappropriate strategies that have worsen relationship ties with key foreign investors, all of which were contributions to Malaysia’s downfall in 2020.

Clearly, the significant decline in Malaysia's FDI was the result of unwilling and prolonged back trailing and inconsistent decision-making by the government then.

There are also other reasons that should be looked at as well. One of the other reasons is from Malaysia’s over reliance on Chinese investments which backfired last year, even though China is one of the biggest investors in Southeast Asia. Foreign investment flows deteriorated sharply when Chinese investment stopped after most of the major contracts were unilaterally cancelled, terminated, or modified. Furthermore, accusations of corruption involving Chinese conglomerates and prominent Malaysian leaders added more scars onto the existing wounded FDI.

2018 and 2019 felt the ripple effect of the country’s 2015 to 2017’s strong economic growth, one of the factors influencing Malaysia’s FDI. Confidence in economic growth over the past few years contributed to healthy foreign investment inflows then. It was a shame that during the 22 months of Pakatan Harapan's sovereignty, time was wasted on a never-ending politically driven dramas instead of policies that could have further anchored Malaysia's economy.

Request for a better environment by foreign investors

With COVID-19, investors are deciding on which countries to invest in. One of the deciding factors for example, is the country’s population rate.Indonesia’s population is around 300 million, unlike Malaysia. Therefore, Indonesia a desirable investment destination for multinational companies such as Tesla Inc. Recently, there has been rumours that Tesla Inc. will be building a supply chain for electric vehicle (EV) batteries in Indonesia.

The size of the Indonesian market is suitable to Tesla's prospects, with the advantage of a surplus workforce. In addition, Indonesia is the world's largest producer of nickel, putting the government in an advantageous position. Nickel is essential for the production of electric vehicle batteries, however despite being one of the world's largest exporters, the Indonesian government has decided to stop exportation of nickel.

The Indonesian government has set forth a vision of popularizing electric vehicles in urban areas by 2030 and has established an integrated supply chain that nickel which is the raw material for electric vehicle batteries into procession of metals and chemicals.

For example, Malaysia’s reputation has suffered from the country's trillions of dollars in debt which were crafted through unconventional accounting practices, and the constant spread of untruthful facts and information.

This is the reason for entrusting unqualified accounts in managing finances. In trying to appear to be the champion of good governance, the Pakatan Harapan government failed to recognize the aftereffects of the continuous spread and occurrence of fake news, especially when it is related to the country's economy and financial management. All these activities weakened Malaysia's economy and took place during the 22 months of the Pakatan Harapan administration. I simply cannot understand how the then-Finance Minister managed to gain investor’s confidence when he constantly stressed the dire state of debt of more than RM1 trillion. This sort of unintended scenario will clearly dampen the economy, which will have a negative impact until 2020.

Ways to improve the country’s FDI

We should learn from our neighbouring countries in relation to FDI. Indonesia and Singapore have managed to implement strategic policies over the past few decades, making them favourable among investors abroad. Take Indonesia for example, they have a clear vision in creating an investor friendly environment.The current Malaysian government should step up their efforts in attracting foreign investors for 2021. They should start by showing a positive attitude towards attracting additional FDIs in stopping the economic slowdown. The government should take advantage of the emergency period in announcing economic revival packages and introduction of effective strategies to stimulate the economy. The government should also act boldly during the current global economy recovery stage from the pandemic in making sure that Malaysia does not fall behind.

Prime Minister Tan Sri Muhyiddin Yassin's announcement of the RM35 billion Pelan Jana Semula Ekonomi Negara (PENJANA) was released just around the right time. It aims to make Malaysia an attractive horizon for businesses. The RM 50 million allocated by the government for the initiative of attracting and encouraging foreign businesses to relocate to Malaysia should be adjusted to an attractive and appropriate amount to successfully attract foreign industries.

On top of that, favorable tax rates and allowances offered have to be competitive with neighboring countries, and the period of special tax rates provided should be extended by at least another 3-5 years. As there are many risks and factors involved with the relocation of a foreign company into Malaysia, Malaysia should offer long-term benefits in making the country stand out.

Another measure for improvement would be to speed up the application processing time for manufacturing licenses and other related licenses, making the country comparable to the fast-processing service offered by countries such as Singapore and Indonesia. This can be easily accomplished by creating an integrated online platform for all ministries to create a seamless expedited process for all related applications, from license applications to applications for tax breaks and incentives.

In addition, the government needs to conduct a well-structured and informative campaign to raise awareness about the advantages of investing in Malaysia. Now is the time for all Malaysian Embassies offices abroad to help targeted multinational corporations in boasting their excellent services in respective countries.

Distribute and create a program for companies in the world’s largest economies, with emphasis on specific areas to Malaysian diplomats working abroad. In addition, we mustn’t forget to build an online presence through media campaigns on all media platforms.

Additional efforts need to be taken in establishing cooperation and commercial partnerships between domestic and foreign business during the midst of growing global and regional demands. Direct support such as tax breaks for sectors that have suffered badly such as the hospitality, transportation, and construction sector will not only help the economy but will also help Malaysia’s 2021 FDI figures to return to the highest level in Southeast Asia.

The last measure would be to strategically expand the options for foreign investors in Malaysia. In this pandemic era, multinational corporations from around the world are looking for other investment destinations. While this poses as an opportunity, the Malaysian government must avoid relying on one particular country as the largest investment destination.

Malaysia should avoid making the same mistake twice with over reliance on China. To avoid this mistake, Malaysia should take advantage of its bilateral relationship with America and major European countries, along with strengthening its ties with the second largest economy, India.

The IMF forecasts Malaysia's GDP to be at 7% in 2021, ranking as the third highest after China and India. Moody's Investor Service has affirmed its A3 rating on Malaysia with a stable outlook. The forecast by the former and rating by the latter shows confidence in the Malaysian economy by foreign experts.

Therefore, it is crucial that the country implements the abovementioned measures in not only attracting more foreign investors, but also in retaining current investors and avoiding retraction of existing foreign investments from the country.

Source

- https://www.mida.gov.my/mida-news/malaysias-fdi-major-factors-and-the-way-forward/

- https://www.researchgate.net/publication/330555790_Foreign_Direct_Investment_Determinants_in_Malaysia

- https://www.dosm.gov.my/v1/index.php?r=column/cone&menu_id=aGlSeWc4WnB5NmVxZTVEV3phZXF3UT09

- https://www.bankrate.com/glossary/i/investment-income/

- https://www.dosm.gov.my/v1/index.php?r=column/cthemeByCat&cat=322&bul_id=OHErYU9wOE9XWnBja3ZGVll5YldiZz09&menu_id=azJjRWpYL0VBYU90TVhpclByWjdMQT09

We hope this article will be useful for those who are considering of doing business in Malaysia.

This article was written by Bridge International Asia Sdn Bhd based on locally gathered information

While we try our best in making sure the information provided in the contents and articles of this site is as accurate as possible, we do not necessarily guarantee the accuracy of the content. Unauthorized reproduction of content is prohibited.

« Questionnaire survey on Malaysia food buye... | Malaysia’s Gross Domestic Product (GDP) tr... »